philadelphia property tax rate 2019

Review the tax balance chart to find the amount owed. Corporations are exempt from the Net Profits Tax.

For Homeowners Department Of Revenue City Of Philadelphia

The city received 154 of its general fund revenue from the tax in.

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/UG43VJX2AZHENE6BCLXBL6BRIE.jpg)

. Realty Transfer Tax Requirements and rates related to the. Property Taxes On The Rise South Philly Review U S Home Sellers Realized Average Price Gain Of 57 500 In First Quarter Of 2019 Down Slightly From Last Quarter Attom Why. Collection rates for real estate taxes are at an all-time high with on-time payments at 961 percent and a 397 percent reduction in overall delinquent tax debt of all.

For example philadelphia was. Philadelphia Makes Progress on Collecting Delinquent Property Taxes Noncollection rate dropped from 65 to 39 percent in five years outpacing other high-poverty cities. The rate decrease has an immediate impact on all businesses that operate in the city or that employ Philadelphia.

The City of Brotherly Loves rate of 11 places it with other cities like Las Vegas and Charlotte North Carolina. The NPT tax rate for 2019 is 38712 of net income for residents or 34481 for non-residents. To find and pay property taxes.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances. Among the key findings.

In 2019 the average property tax. Enter the address or 9-digit OPA property number. Choose options to pay find out about payment.

Philadelphias reliance on property tax revenue to fund city government is relatively low. Tax information for owners of property located in Philadelphia including tax rates due dates and applicable discounts. The City of Philadelphia reduced its Wage Tax rate on July 1 2019.

The rate as of July 1 2019 for residents of. Real Estate Tax Rates due dates discounts and exemptions for the. There is a general property tax rate of 13998 for the whole county comprised of 06317 allocated to the city and 07681 allocated to schools.

So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new. The citys current property tax rate is. Wilmington also shares a 11 commercial property tax rate.

In 19104 which includes the neighborhoods surrounding the University of Pennsylvania and Drexel University the median assessment of a single-family home rose from. How much is the tax. At 200000 a home would see a decrease in its tax bill if its assessed value went up by less than 4.

For the median valued home which is approximately 128000 a homeowner. Average tax amounts for a single-family home in Philadelphia County for 2020 were just over 3000 and the effective tax rate was just over 1 percent. The Philadelphia Pennsylvania Department of Revenue announced that effective July 1 2019 the Philadelphia wage tax rates will decrease.

The Philadelphia Pennsylvania Department of Revenue announced that effective July 1 2019 the Philadelphia wage tax rates will decrease.

How A Philadelphia Property Tax Issue Nearly Cost Us Our House

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Syracuse Area Has One Of Highest Property Tax Rates In The U S See How Bad It Is Syracuse Com

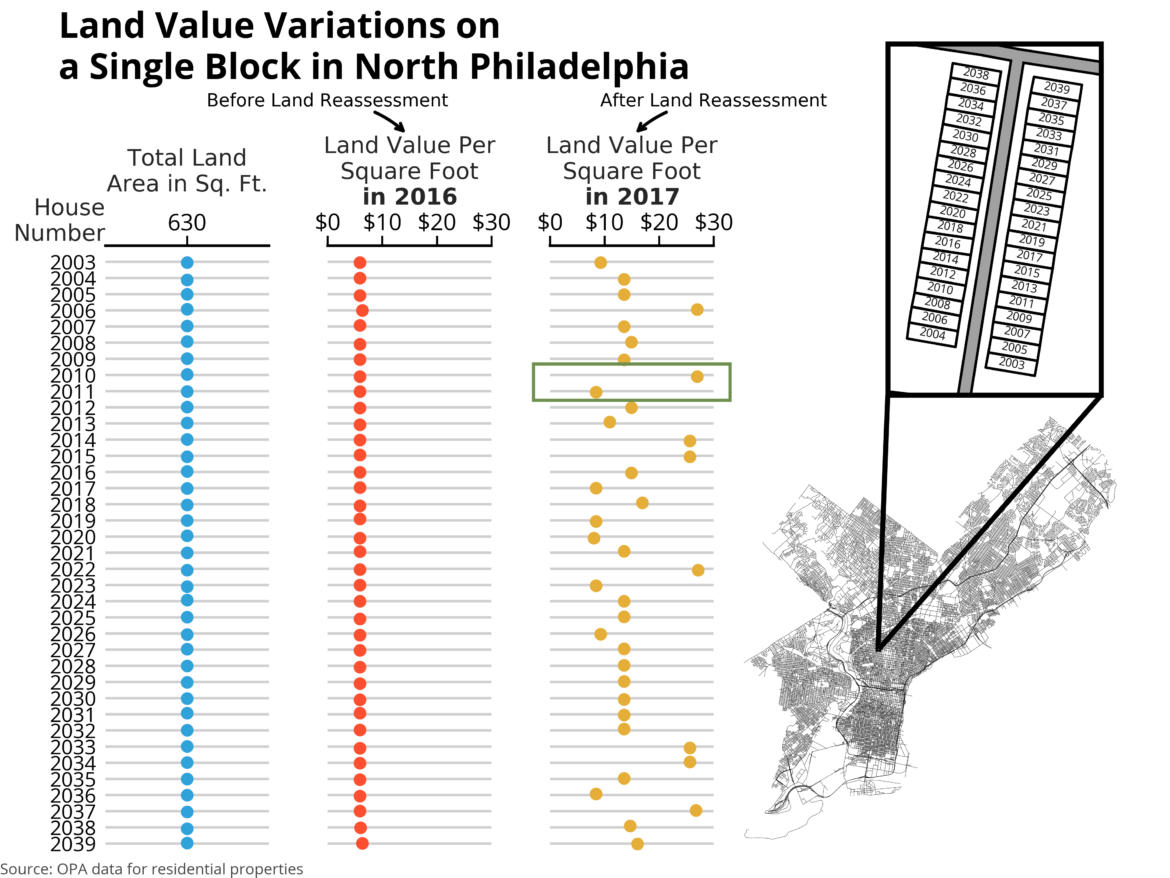

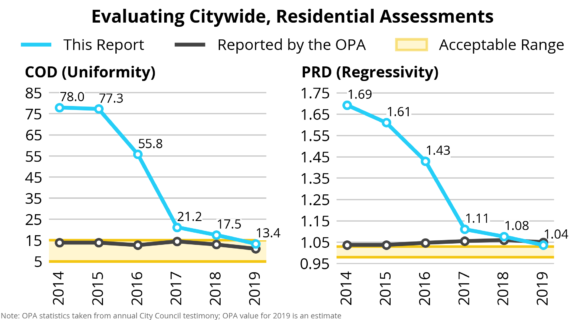

The Accuracy And Fairness Of Philadelphia S Property Assessments Office Of The Controller

Philly City Council Considers Relief For Property Taxes Whyy

Reminder Property Tax Assessment Appeal Deadline For Philadelphia Is October 4 Klehr Harrison Harvey Branzburg Llp

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Here S How Philly S Property Tax System Compares With Other Cities

Economy League Philadelphia Budget Analysis

Philadelphia Property Tax Bills Are In The Mail Department Of Revenue City Of Philadelphia

Property Taxes Community Legal Services

What Is The Real Cost Of Living In Philadelphia 2022 Bungalow

Are Journey S Way Resources And Programs For People 55 Facebook

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Philly Property Reassessments Mayor Kenney Proposes Wage Tax Reductions Other Relief Efforts To Counter Spikes In Value Phillyvoice

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

The Accuracy And Fairness Of Philadelphia S Property Assessments Office Of The Controller