costa rica taxes pay

As of 2019 JetBlue does not include the departure tax in the ticket price for Costa Rica. The departure tax is a mandatory.

Costa Rica Cr Revenue And Grants Revenue Taxes On Goods And Services Of Revenue Economic Indicators Ceic

When you purchase a property in Costa Rica the first tax you will be paying is the property transfer tax Impuesto de Traspaso.

. When property is purchased in Costa Rica it must be transferred into the buyers name. If you make income from Social Security a pension real estate investments in your passport country through an online. Income tax is only paid on revenue earned within Costa Rica.

In other countries you pay state tax or sales tax. The property transfer tax is 15 of the. In case of legal entities income tax ranges from 10 to 30.

The tax increases slightly each year and is due. The key legislative authorities in Costa Rica are. The Costa Rica tax year runs from 1 January to 31 December.

1 day agoEach corporation must pay an annual corporate tax which in basic terms for corporations that have no activity will be less than 70000 colones per year for 2022 about. According to our knowledge the following is the breakdown of the property taxes that homeowners pay to the government in their respective communities. How to calculate your salary after tax in Costa Rica.

Costa Rican Social Security Fund Caja Costarricense del Seguro Social. This involves a property transfer tax of 15 of the property value. Income tax rates for both companies and individuals are calculated on a progressive scale depending on gross income.

However the law establishes special regulations for small companies whose gross income does not exceed 112170000 Costa. Costa Rican income tax is payable on any income that is generated in Costa Rica for residents or non-residents. The revenue goes into the Governments.

For individuals domiciled in Costa Rica any income obtained within the boundaries of Costa Rica is considered as Costa Rican-source income and is taxable. A resident for tax purposes is anyone who spends more than. In another article you can find out how to move your household without having to pay too much import tax in Costa Rica.

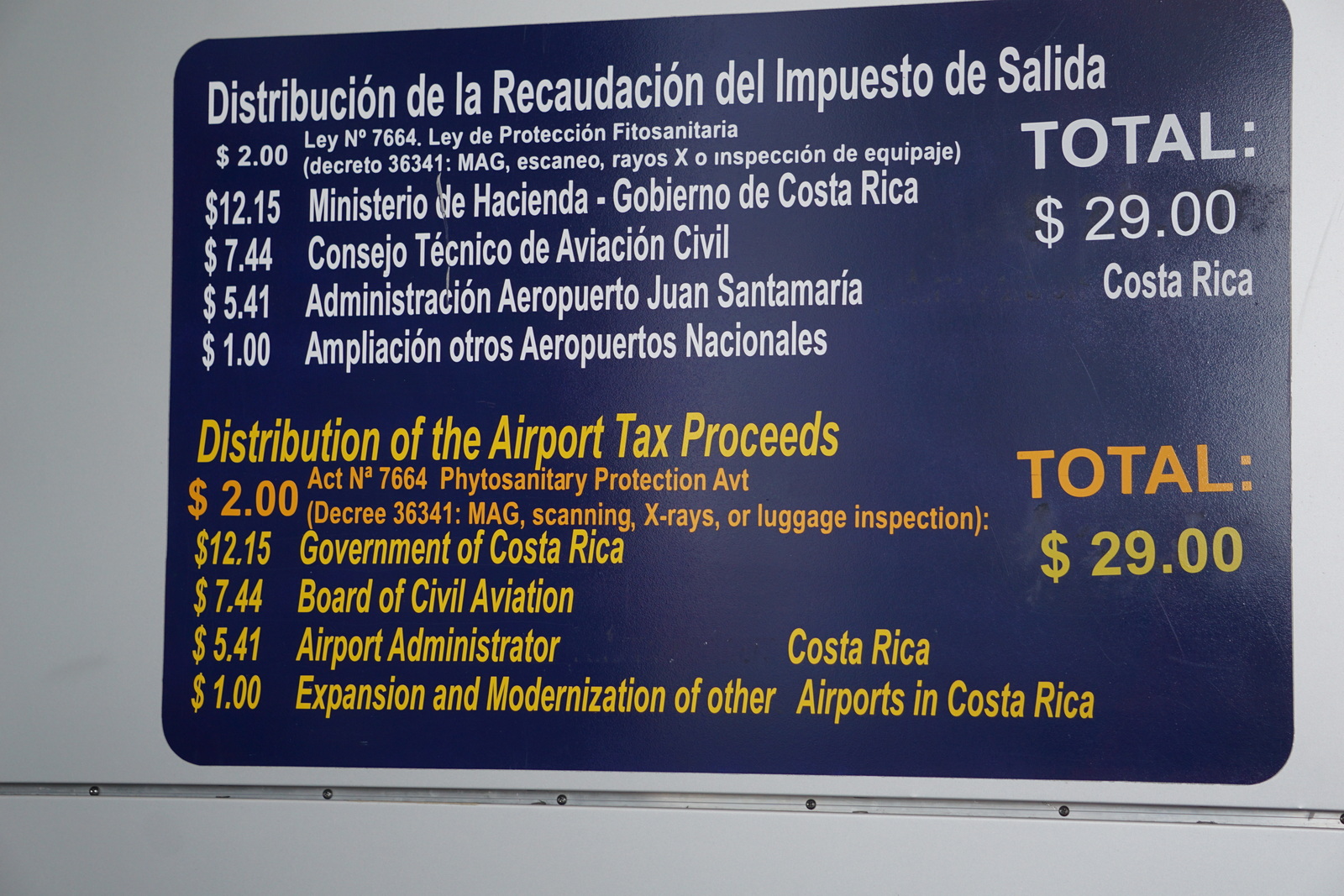

Corporate income is taxed at a 30 rate. Costa Ricas laws require all passengers departing Costa Rica by air whether adult child or infant to pay an Exit Tax of US2900in cash. Follow these simple steps to calculate your salary after tax in Costa Rica using the Costa Rica Salary Calculator 2022 which is updated.

Sales Tax now IVA. The Costa Rican government not only taxes active corporations those that actively do business but also inactive ones. The resolution establishes that taxpayers classified as national large taxpayers grandes contribuyentes nacionales must settle debts due from 18 April to 22 April within.

Property Tax In Costa Rica When To Pay Luxury Tax Too Youtube

Don T Forget To Pay Your January Taxes Cribo Costa Rica

Costa Rica Property Transfer Taxes Q Costa Rica

All About The Taxes Of Costa Rica Special Places Of Costa Rica

Dentons Munoz Costa Rica Compliance With Tax Obligations For Companies Registered In The Country

Dentons Global Tax Guide To Doing Business In Costa Rica

Businesses In Costa Rica Pay Some Of Region S Highest Taxes Costa Rica Star News

Dentons Munoz Costa Rica The Deferral On The Payment Of Taxes Ends Tax Relief Law Due To Covid 19

Simple Tax Guide For Americans In Costa Rica

Company Regulatory Compliance In Costa Rica A Guide

Simple Tax Guide For Americans In Costa Rica

Costa Rica S Luxury Home Tax Everything You Should Know

Manitoba Premier Gets Proof Of Payment On Taxes Owed On Costa Rica Home Cbc News

Departure Tax Exit Tax Changed In 2018 Or Maybe Not

Taxes In Costa Rica International Living Countries

Costa Rica Number Of Taxes Data Chart Theglobaleconomy Com

Costa Rica Cost Of Living 2022 How Much To Live In Costa Rica

The Real Story Behind Corporate Taxes In Costa Rica Properties In Costa Rica Blog